How does Cash App Work? : Cash App Primary Features, Explained

Cash App is nothing but an easy way to send and receive money digitally. To use it, all you have to do is create your account and start making transactions accordingly. Also, it isn’t just sending or receiving money, but more than that. Here’s your guide to know more about how the Cash App work.

Working of Cash App

Using your Cash app account that you created, you can start making the transactions using your debit card which is linked to your bank account.

With Cash App, you also have a facility of a cash app account. You can transfer the funds from the cash app account to your bank account which might take approximately 2-3 business days.

There are Two Key Features of Cash App and They are:

- Paying people

- Getting paid

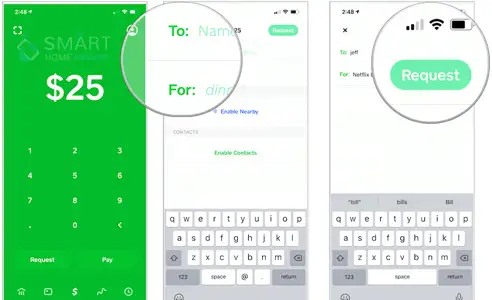

To make the cash app work, you will have to tap on the $ sign on the button of your screen and then enter the amount you want to transfer in the question asked. Next, tap on the "Request" or "Pay," depending on the circumstances and then, enter the other party's $cashtag (or email or phone) and send or request the money.

One of the things that makes Cash App different from other online payment platforms is the free Visa-certified debit card that we call as a cash card, that you can request as well. This debit card is then used at standard brick-and-mortar retail locations and at ATMs to take out cash.

However, while making transactions or especially while transferring the funds, make sure to check the receiver's address and account details thoroughly; because even the slightest mistake can make you regret it. That is because you won’t know if they will be returning the money back.

We hope the above article helped you to know about how the Cash App work.

Published by: Blaze

Published by: Blaze Brand: Smart Devices

Brand: Smart Devices Last Update: 2 months ago

Last Update: 2 months ago

Related Blogs

Related Blogs

How to Use Google Lens on iPhone?

Top 7 Best Smart Home Security Systems of 2025

How to Connect Philips Hue Devices?